minnesota unemployment income tax refund

If you received unemployment in 2020 the federal government decided up to 10200 of that money would be tax free to help people out during the pandemic. It currently has no Senate companion.

These payments are considered a.

. Employers with an active employer. Refunds for about 550000 filers who paid state taxes on the extra 300 and 600 unemployment payments. Use our Wheres My Refund.

Get market news worthy of your time with Axios Markets. About 500000 Minnesotans are in line to. The Minnesota Department of Revenue announced last week that about 1000 refunds will go out this week a process that officials hope will ramp up to roughly 50000 per week by late October.

For taxable year 2020 Minnesota tax law now allows the same unemployment income exclusion as federal tax law. Unemployment tax refunds started landing in bank accounts in May and ran through the summer as the IRS processed the returns. The first phase included the simplest returns made by single taxpayers who didnt claim for children or any refundable tax credits.

When Will I Get The Refund. As of January 27 2022 we have. Refunds for about 550000 filers who paid state taxes on the extra 300 and 600 unemployment payments issued during the pandemic likely wont go out until.

Reports must be received on or before the last day of the month following the end of the calendar quarter. Adjusted about 540000 Individual Income Tax returns and issued refunds to taxpayers affected only by the UI and PPP changes. Tax refunds on pandemic payroll unemployment benefits still in limbo.

Quarterly UI Wage Detail Report. MINNEAPOLIS WCCO The Minnesota Department of Revenue has started processing Unemployment Insurance and Payback Protection Program PPP refunds that have been delayed due to tax law changes. We know these refunds are important to those taxpayers who have.

In the latest batch of refunds announced in November however the average was 1189. Are the IRS economic impact payments included in household income for the Minnesota Property Tax Refund. The latter will vary between households depending on overall income your tax bracket and how much of your earnings came from the benefits.

More complicated ones took longer to process. The form will be mailed to the address listed in your account on December 31 2021. Weve finished adjusting 2020 Minnesota tax returns affected only by law changes to the treatment of Unemployment Insurance UI compensation and Paycheck Protection Program PPP loan forgiveness.

If you enter an account that exceeds this limit well send your refund as a paper check. FOX 9 - Minnesota will take weeks or months to refund taxes paid on unemployment benefits and COVID-19 pandemic-related business loans. You can If you received unemployment in 2020 and filed BEFORE Minnesota changed their law of taxing the unemployment income you may be getting a letter informing you that you will be receiving an.

The form shows the total benefits paid and all federal and state income taxes withheld. PAUL WCCO Businesses that received forgivable payroll loans from the federal government and Minnesotans who got extra jobless benefits last year will begin seeing state tax refunds in the next few weeks the Minnesota Department of Revenue said Thursday after the legislature signed off on a tax relief package before ending their work. On September 13th the State of Minnesota started processing refunds to those that had paid income tax on the first 10200 on their unemployment income.

It would create the same temporary tax subtraction for tax year 2021 as was in effect for tax year 2020 with up to 10200 in unemployment benefits subtractable from taxable income. System to follow the status of your refund. Mailing will begin in mid-January and will be completed by January 31 2022.

Each quarter employers that have employees in covered employment are required to submit a wage detail report electronically. The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year. Minnesota Law 268044 Subd1.

On Wednesday the bill as amended was laid over by the House Taxes Committee for possible inclusion in an omnibus tax bill. Direct Deposit Limits We only deposit up to five Minnesota income tax refunds and five property tax refunds into a single bank account. January 27 2022 - The Minnesota Department of Revenue announced today that the processing of nearly 540000 tax returns impacted by changes made only to.

Subscribe for freeWhats happening. State officials say refund checks should start going out this week to roughly half-a-million Minnesota taxpayers who filed returns before the legislature passed a law affecting COVID unemployment insurance benefits and businesses Paycheck Protection Program payments making them exempt from Minnesota income tax. Minnesotans who received enhanced unemployment benefits or Paycheck Protection Program loans last year can expect to wait a little longer for tax relief from the state.

Minnesota Unemployment Refund Update September 15 2021 by Sara Beavers On Thursday September 9 th the Minnesota Department of Revenue announced the processing of returns impacted by the tax law changes made for the treatment of unemployment insurance compensation will begin the week of September 13 th. Yet despite months of lead time no one can say when the checks will get cut. IRS Form 1099-G will be mailed to everyone who was paid Minnesota unemployment benefits in 2021.

Minnesota owes half a million taxpayers a refund. September 13th 2021. But a lot of people still paid state taxes.

For details see Direct Deposit. - The Minnesota Department of Revenue announced today that the processing of returns impacted by tax law changes made to the treatment of Unemployment Insurance compensation and Paycheck Protection Program loan forgiveness will begin the week of September 13.

Mn Sales Taxes If You Re A Business That Sells Taxable Products Or Services In Mn Whether You File Monthly Or Quart Meant To Be Instagram Posts Sales Tax

The Messy Fight Over Minnesota S Unemployment Insurance Trust Fund Explained Minnpost

Minnesota Expects Record 7 7 Billion Budget Surplus Wcco Cbs Minnesota

Where S My Refund Minnesota H R Block

As High Unemployment Persists Minnesota Borrows To Pay More Benefits Federal Reserve Bank Of Minneapolis

House Workforce Committee Oks 1 2 Billion Plan To Repay Mn S Unemployment Trust Fund Session Daily Minnesota House Of Representatives

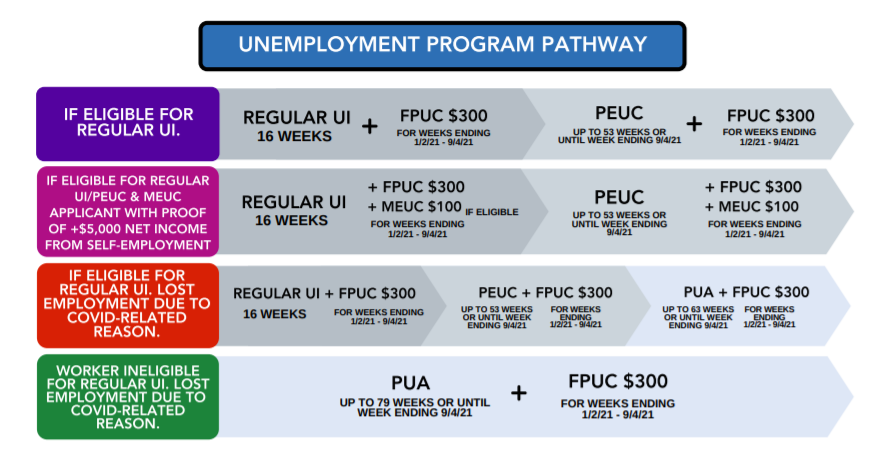

Minnesota Mi Deed Unemployment Benefit Extensions To 300 Fpuc Pua And Peuc Programs Has Ended Retroactive Payment Updates Aving To Invest

Minnesota Passes Tax Bill Including Ppp Conformity Olsen Thielen Cpas Advisors

Covid 19 Coronavirus Resources International Institute Of Minnesota

Minnesota Guidance On Federal Unemployment Compensation Exclusion

Mn Department Of Revenue Will Begin Sending Tax Refunds For Ppp Loans And Extra Jobless Aid In Next Few Weeks Wcco Cbs Minnesota

Daycare Business Income And Expense Sheet To File Your Daycare Business Taxes Page 2 Taxtime Incom Starting A Daycare Daycare Business Plan Childcare Business

File 2021 Minnesota State Taxes Together With Your Irs Return

Minnesota Tax Forms 2021 Printable State Mn Form M1 And Mn Form M1 Instructions

Minnesota Got A Letter 6 Months After Benefits For An 8 5k Overpayment R Unemployment

Minnesota Unemployment Know Your Rights Aboutunemployment Org